Economics

Supply-Side Economics and American Prosperity with Arthur Laffer

8 lessons

6h total length

Create Your Account to Get Instant Access to “Supply-Side Economics and American Prosperity with Arthur Laffer”

Learn how Americans can restore economic freedom and prosperity.

Lessons in this course

25:01

lesson 1

The Five Kingdoms of Macroeconomics

Government actions in the five kingdoms of macroeconomies—taxation, spending, money, regulation, and trade—provide positive or negative incentives that influence the decisions citizens make.

23:00

lesson 2

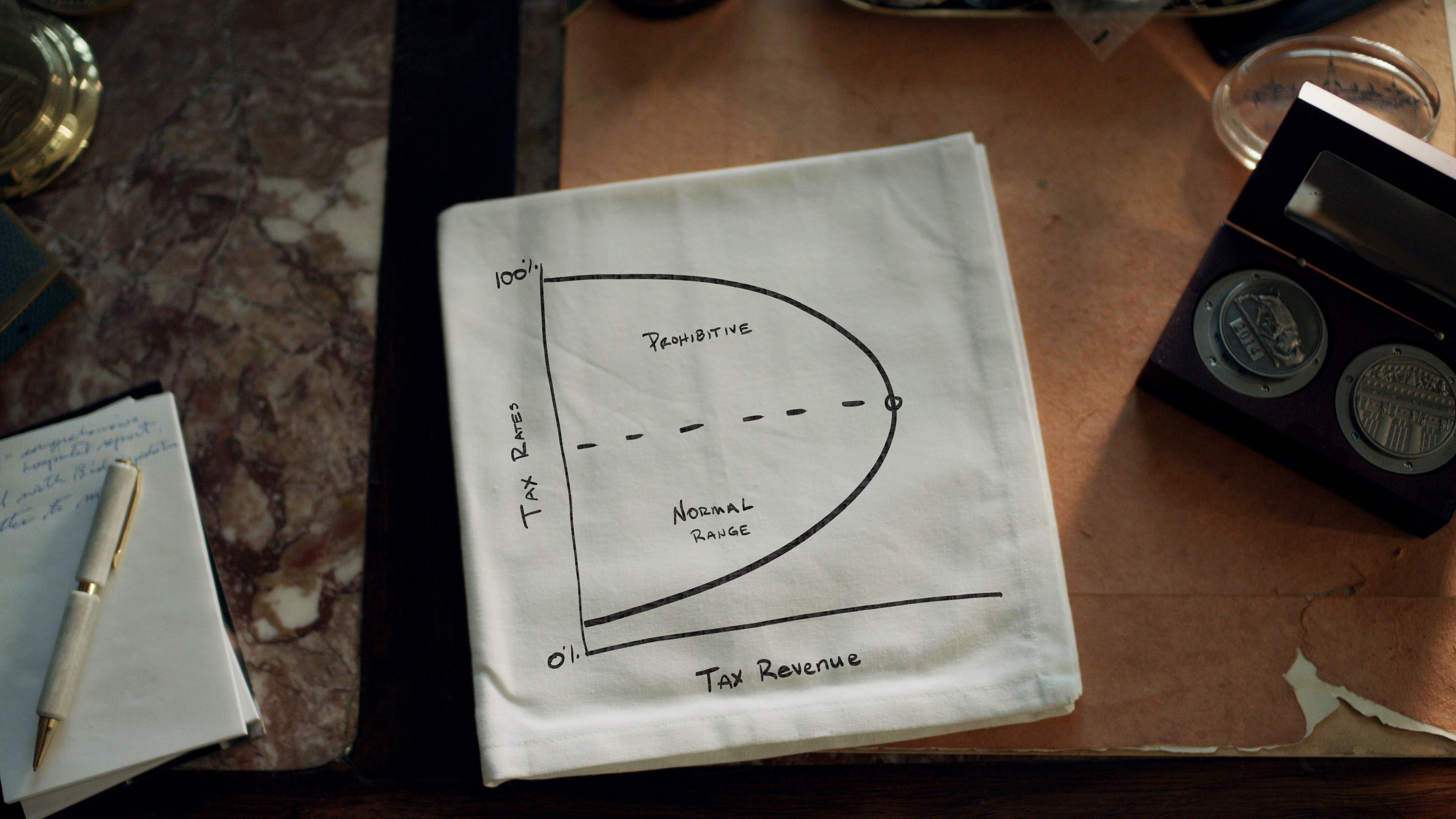

The Laffer Curve

The Laffer curve represents an old economic principle that explains why raising tax rates does not always result in an increase in tax revenue. Higher taxes disincentivize production and reduce the total tax base from which revenues can be drawn. The widespread acceptance of this idea—made popular through the Laffer curve—helped spark the economic boom of the 1980s.

31:33

lesson 3

American Taxation: The Great Depression to Today

The economic history of America since 1913—the year the federal income tax was introduced—reveals the negative effect of high taxes on the economy. The Great Depression was largely caused and perpetuated by tax hikes combined with increased spending. The Kennedy, Reagan, Clinton, and Trump administrations have all proven that cutting taxes, especially on the top producers, benefits the overall economy.

33:53

lesson 4

Income Inequality

Today’s argument that income inequality is best addressed by raising taxes is false. Eras of high taxation in America have slowed the economy, incentivized the wealthy to shelter their income, and shifted the tax burden onto lower income earners.

27:32

lesson 5

Why States Prosper

Free trade between the states and the free movement of populations within the United States makes clear the effects of the economic policies of individual states. In every significant metric, the states with lower tax burdens outperform the states with higher tax burdens—even in the provision of services to their citizens.

28:29

lesson 6

The Consequences of Redistribution

Government does not create resources; it simply transfers them. Thus, any benefit a stimulus bill or redistribution program brings to a recipient is offset by a tax placed on citizens to raise the necessary money. The net effect is negative because both those who are taxed and those who receive the stimulus are disincentivized from working and producing.

37:41

lesson 7

Trade, Debts, and Deficits

Trade allows people to exchange the goods they produce most efficiently for a variety of goods at the lowest price. Reagan’s economic policies demonstrate how trade—and the proper understanding of debts and deficits—can be used to bolster the economy.

27:24

lesson 8

The Pillars of Prosperity

Common-sense policies in the five kingdoms of macroeconomics will unleash American prosperity again. Americans must be free to produce and secure in their earnings. To provide genuine economic growth in impoverished neighborhoods requires economic reforms that incentivize growth.

Watch the course trailer

Enroll in "Supply-Side Economics and American Prosperity with Arthur Laffer" by clicking the button below.

What Current Students Are Saying

It tells the truth about supply-side economics, the impact of taxes and how the economy really works. And it does this in a way that anyone can understand it, regardless of their educational background or expertise.

Create your FREE account today!

All you need to access our courses and start learning today is your email address.